NVISION Spinoff and Abandonment

Birney Dayton was an early proponent of HD. He was dismayed that the Group at times seemed to have no interest in how future technologies would disrupt their business model. He was a witness to the meeting they had with Sony in 1985. He saw what others were doing in the digital space. Besides the two digital islands in the company at the time, Dubner and the linage that started with the Kscope, it was analog and standard definition through and through.

Even when Bell Labs approached the Group to do R&D on HD, the majority of the company did not see the value. Dayton lobbied for some foray into digital, especially HD. He had the ear of Tom Long. Dayton considered Long a mentor. Long was in a position to see farther out in the future and thought some of Birney's arguments had merit, but also thought they might be too disruptive to setup a HD R&D operation inside the Group. He asked Birney if he could make a business out of his vision of the future. He said he could. Long arranged for Tektronix funding. This was at a time when many companies had Venture Capital funds. Tektronix's VC arm was called Tektronix Development Capital, or TDC. TDC's investment was half in money, $2 million, and half in test equipment. Dayton promised Long that he wouldn't compete with the Group, which would be easy as the Group had no interest in HD. The company launched in 1989. This was the only Tektronix sanctioned spinoff ever from the Group.

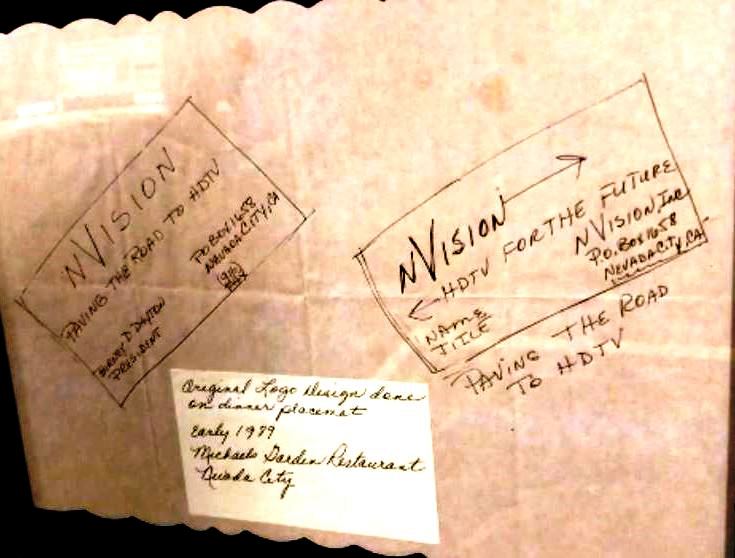

The new company took the name of NVISION. The N represented any line rate; 525, 1080, 1120, 2000, in a television picture, the VISION tag. The name was created in 1989 on a place mat from Michael's Restaurant by Birney and Roni Dayton and Helen MacMillian.

Founders Birney Dayton, Bill Amos and Guido Galli

Besides Dayton and his wife Roni, Bill Amos, and Guido Galli were the founders of the company. Bill Amos was at one time the head of sales for the Sony Umatic line of VTRs. Amos was a Philips salesman, selling camera imaging tubes, eventually ending up in the telcom industry, before Pete Mountanos brought him to Grass Valley, as he thought he make a good sales person for Wavelink. After Mountanos left he got to know Birney Dayton. When Birney started NVISION he brought Bill along. Amos was in charge of the new company's sales. Guido Gali was in charge of manufacturing.

Galli had a doctorate in physical chemistry. He had a number of patents surrounding computer memory, (especially bubble memory), and ink jet printing. He had worked at IBM before moving to Intel. Birney had talked about going off to start his own company while at Grass Valley. Mountanos was also instrumental in Birney meeting Galli, as he had ties to a venture capitalist firm. Before Mountanos finally decided to leave, he was trying trying to get Birney to leave. His hope was that Galli could lead him to startup money.

Bob Plumber and Larry Thorpe of Sony were on the board. Birney knew both Thorpe and Plumber from his time on the ACATS committee. Plumber worked for Sarnoff Labs. Larry Thorpe was originally with RCA and was instrumental in the TK-47 camera we looked at earlier in this chapter. He came to Sony as their camera guru for Sony America. He was actually going to leave Sony for NVISION so that the fledgling company could also compete in HD cameras, but the Chairman of Sony, Morita himself, talked him into staying with Sony.

Jerry Sakai spent some time at NVISION for a while. Galli had left the startup as he was not keen on the intricacies of small batch manufacturing, and Sakai naturally was. Another early member of the company was Chuck Meyer, who joined as a senior engineer. Initially Dayton was a bit leery of Meyer, because he did not stay long in his first stint with the Group. Meyer thought he was not a good fit in the Wavelink group. After stints in marketing Chuck eventually became head of engineering, and eventually towards the end of NVISION's run as a standalone company, its President.

First Clientele

From the get-go it became obvious that HD was not ready for prime-time. But high end television and audio production houses, along with Hollywood, were discovering a form of high definition audio. AES audio. AES stood for the Audio Engineering Society, that had hammered out a digital audio standard. Many in the industry found that digital audio was a much harder concept to grasp than digital video, albeit standard definition at this point. Many things were foreign when comparing analog audio to digital audio. For one thing how levels were measured was different, there was much more ancillary data embedded in the digital audio signal than in video'. In addition our ears are much more unforgiving, at least among audiophiles, to minor imperfections in digital audio than digital video.

Now to insure audio fidelity from a new sound phenomenon introduced with digital audio, "clicks and pops" when switching between audio sources, the audio had to be synchronized properly. Sync generators for audio? Some old timers found it blasphemy. But when correctly done AES digital audio made for much better sound.

Al Hart, a member of the nascent company came to Birney and said they needed to develop a timing generator to solve that problem. They developed a box called the NV1082. It locked to the video reference and generated a 48KHz AES clock signal. They sold that product for five years until Tektronix came out with a product that did video and audio timing all in the same box. In conjunction with that NVISION also produced a family of products that converted analog audio to/from AES. This was the start of the company's modular product line. Not in HD video products, but in a form of higher definition audio products.

Hollywood was a big customer of these products and used them mainly for digital audio mastery. Chuck Meyer said that he liked Hollywood customers, as they respect other creative types more than the hard nosed broadcasters generally do. NVISION did very well with the Hollywood types.

Another early NVISION product was the 3512 AES audio synchronizer. NVISION soon came out with a SDI video router, the 8256 for ABC. This was almost five years before the group introduced their own. It originally handled SD digital video, but soon was upgraded to HD. But the HD video market just wasn's there yet. It was still looked upon as a science experiment by many.

HD - Failure to Launch

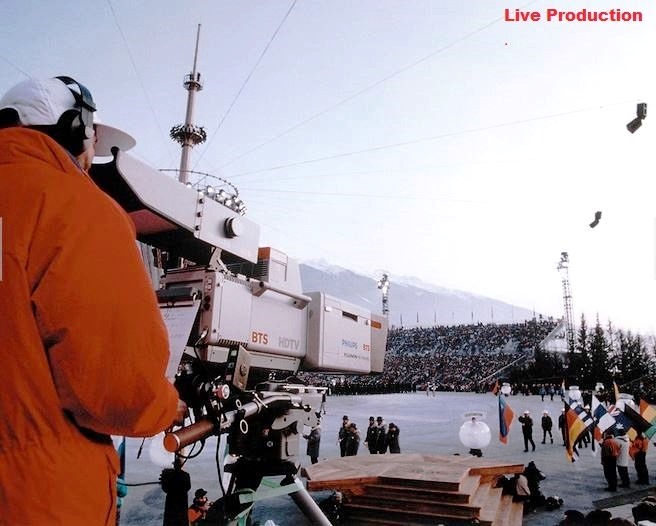

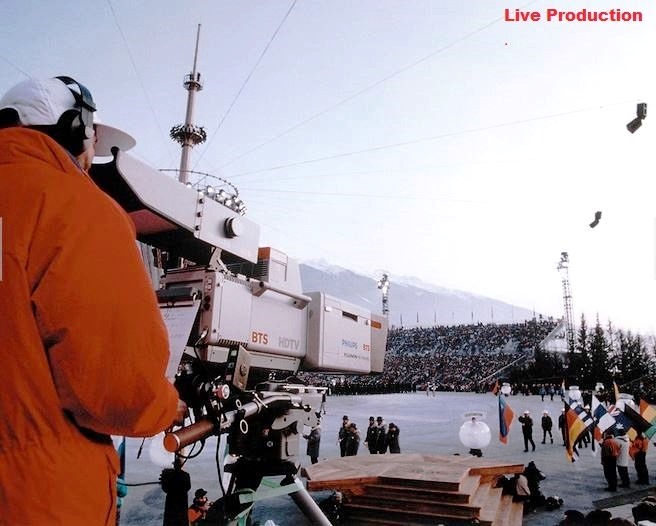

In 1992 at the Albertville Winter Olympics, HD was used for the first time to cover a large sporting event. It was a joint effort between Bosch, Phillips, and Thomson, the joint company was known as BTS. All four of these entities would come to be a big part of the Grass Valley story. BTS assembled nine HD production trucks for the event, ranging from two 6 camera vans, and one 4 camera van, two 2 camera vans, an edit truck, and two slow motion units, plus a master control unit. They also built a two camera studio facility.

This HD system was still analog, not digital. Quality was definitely better than standard definition. But not enough to justify the cost. Receivers and monitors were still CRT based, which made them big, heavy and extremely expensive. Also many thought the new 16:9 aspect ratio (4:3 was the traditional one) was too exotic. But outside of a few demonstration type projects, few were interested in making the investment that HD required. Plus who would watch it? There was no way to deliver it live to the home, and in 1993 HD receivers were in the $15,000 range, in 93 dollars. BTS disbanded the units in 1996.

While Sony had the deep pockets to patiently build up a need and demand for HD and it continued along that path. NVISION had no such resources. Casting about for products that would keep the doors open they thought about doing a more advanced version a audio product similar to a product that Dayton had worked on at the Group, which worked over fiber. But they soon found that there wasn't a market for it. But that work soon morphed into what was known as the NV-2000. It moved six audio channels in a 6 MHz video channel. Chuck Meyers flew all over the US trying to sell it, with very limited luck. But there was another market that NVISION was about to stumble on. Chuck went to Modern Video Film in Burbank trying to sell the 2000. They said that they did not know what to do with it, but they mentioned another need. They said they had a need for a data or machine control router.

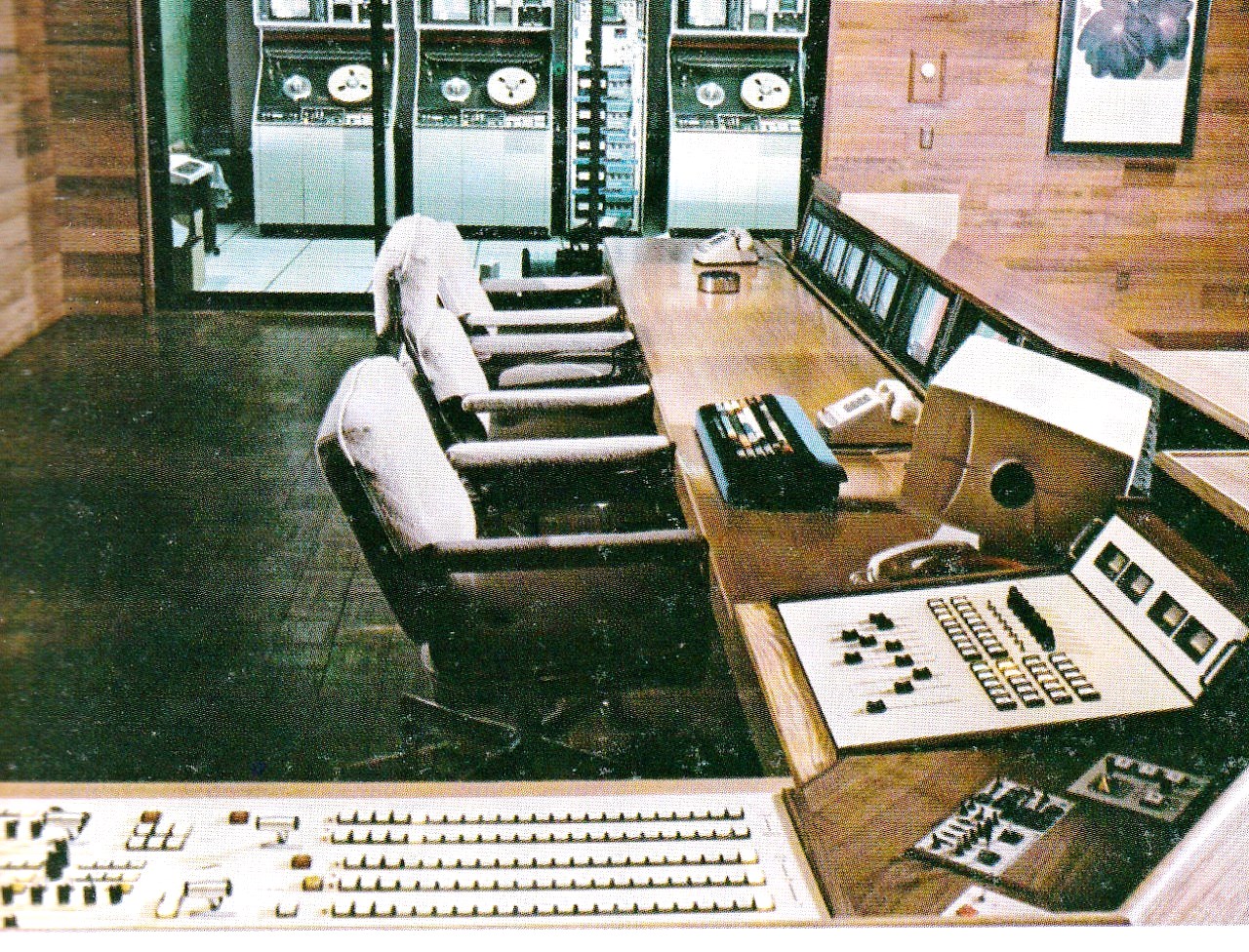

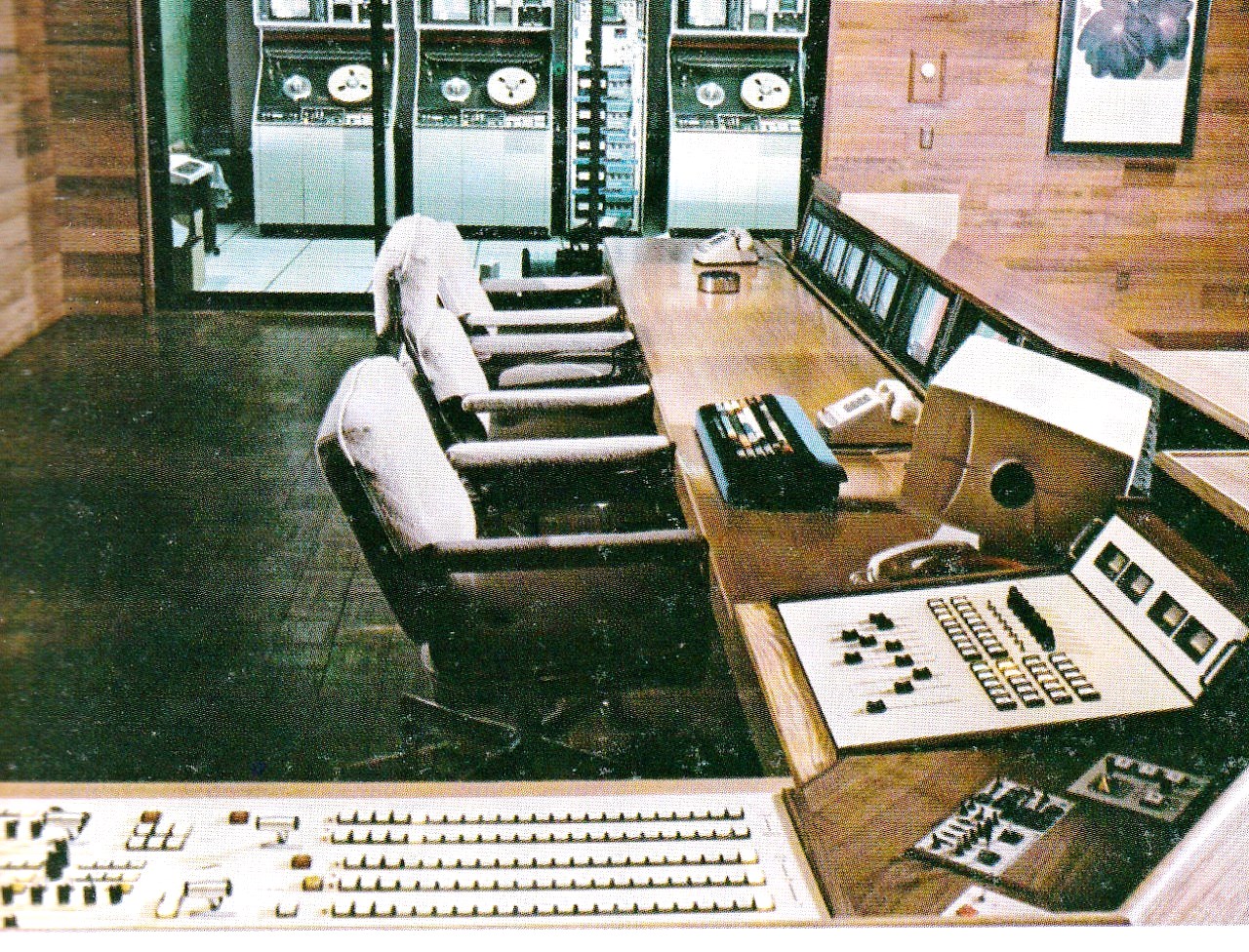

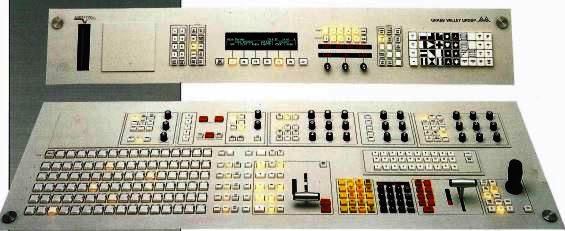

Facilities were looking for an easier way to reconfigure machine control in edit bays. At the time editing was not done on a laptop or even desktop computer. It consisted of two or more VTRs, maybe a video switcher, and audio mixer, and a stand alone editor, generally the only computer in the room. The editor controlled the VTRs, and other equipment associated with the editor. Often what particular machine was currently under the control of an editor would need to be changed. Up until then that required either patching, or physically disconnecting a cable from one machine and moving it to another.

90's edit suite. Switcher bottom left, audio mixer bottom right. Keyboard and monitor for the editor on console. The three VTRs in an adjacent room were to limit the noise coming from the machines. Rack between the center and right VTRs held control interfaces for each thing controlled, in this case the VTRs, video switcher, and audio mixer. Each interface was about 16 inches tall in the rack. The editing computer itself, which talked to each interface, was a DEC PDP-11 mini-computer.

90's edit suite. Switcher bottom left, audio mixer bottom right. Keyboard and monitor for the editor on console. The three VTRs in an adjacent room were to limit the noise coming from the machines. Rack between the center and right VTRs held control interfaces for each thing controlled, in this case the VTRs, video switcher, and audio mixer. Each interface was about 16 inches tall in the rack. The editing computer itself, which talked to each interface, was a DEC PDP-11 mini-computer.

Glen Meadows who was a big-time Nashville sound engineer, also wanted a data or machine control router, and he eventually called Frank Wells, an NVISION engineer, and said come on down, he had an idea for a solution to the issue. He asked why a analog video or AES router couldn't be modified to be a data router? Jim Varney and Bob Fry asked Meyer if they could make an audio router into a control data router. Together with Chuck and Bob Crab they simulated it with a 3512.

Names correct

Machine Control

They had a hit on their hands. NVISION sold data routers to everyone but Grass Valley.

No Tek Round Two

By 1992 NVISION, spun off three years earlier, needed another cash infusion. Jerry Meyer, the President of Tek at the time, had no interest in anything small. Meyer was known for having little patience, especially towards the Group. NVISION scrambled to find another investor, which they did. Dayton approached Jim Meadlock, who he had directed the Group to help with building Kscope boards, as we saw a bit earlier.

Jim Meadlock - 2019

Meadlock had ran Intergraph, started by former IBM engineers in 1969 as M&S Computing, Inc.. Jim Meadlock, his wife Nancy (the M in the name), Terry Schansman (the S), Keith Schonrock, and Robert Thurber were the founders. Thurber had been working with NASA and the U.S. Army in developing digital computing systems to provide real time missile guidance. In 1980 the company was renamed Intergraph Corporation.

One of Intergraph's major hardware projects was developing a line of workstations using a computer architecture created by Fairchild Semiconductor. They also developed their own version of UNIX for the architecture. In 1987 because the Fairchild product wasn't very popular, Intergraph bought the Fairchild division responsible for the chip to insure its continued availability.

Their Unix product became a big money-maker, but not in a traditional way. In 1997, Intergraph brought suits against Intel and other computer hardware manufacturers claiming intellectual property infringement. The company secured major settlements with Intel, HP, TI and Gateway, racking in over $394M. In 2000, Intergraph exited the hardware business by selling its it's existing graphics accelerator IP to 3Dlabs, and its workstation and server division to Silicon Graphics, thus becoming solely a software company.

On November 29, 2006, Intergraph was acquired by an investor group taking the company privately until 2010, when Intergraph was acquired by Hexagon AB.

Meadlock was born in 1933, and received his Bachelor of Science in Electrical Engineering, from North Carolina State University, in 1956. He was a department manager for IBM until he left to form Intergraph, where he was Chairman, Board Of Directors, and the chief executive officer for the company.

For an additional infusion of capital NVISION went straight to Tektronix's board, but the board said no. By then there was some resentment, both at Tektronix, and the Group that Tektronix had funded NVISION, and had not kept it inside Grass Valley. Jim Meadlock put money in and watered Tektronix shares down. Meadlock wrote a personal check for $1 million. Tektronix held fast in choosing not to invest any more than their initial outlay. Eventually Meadlock virtually washed down Tektronix shares to 0.5%. Meadlock felt that you had to pay to play. Meadlock had about $4 million into NVISION when he was done.

Part of Meadlock's money was used on a down payment for a building that was originally a Blue Cross data center. The building was bought for about $750,000 and had $200,000 in improvements made. That is the same building seen in chapter one, as it is the last building still associated with the Grass Valley Company in the area.

The Book

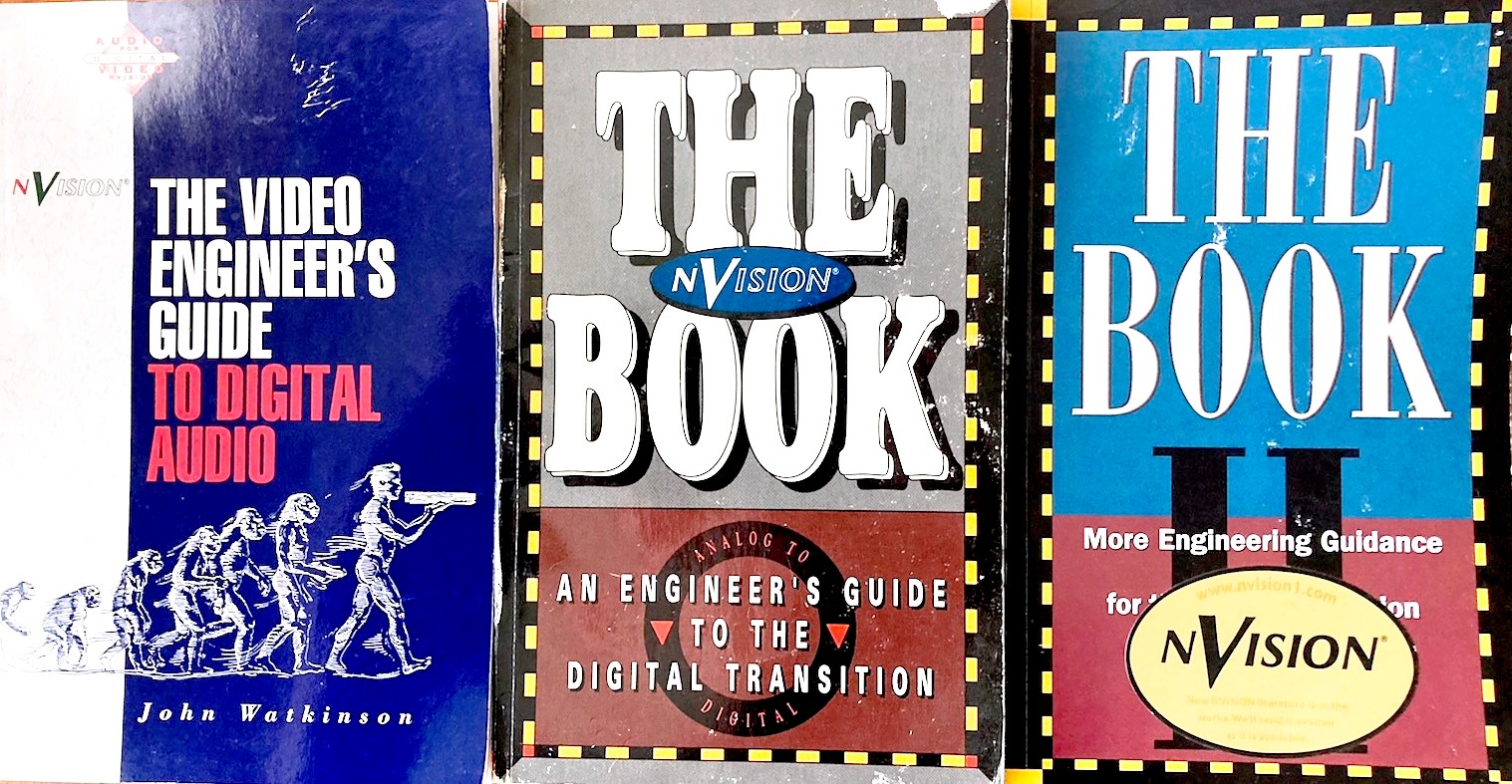

Birney picked Chuck to define the digital audio product line for marketing. So he worked on creating a catalog and application notes, which then led to the writing of the first "The Book."

There were three editions of "The Book", which rapidly became the bible for many engineers faced with harnessing digital audio. It made NVISION the de facto digital audio gurus. As we will see later in the book that there was a previous holder of that title, another group which left the group and started their own company.

While the application notes were written by Meyer and other NVISION engineers, John Watkinson, who wrote "The Art of Digital Audio" at about the time NVISION started, agreed to take NVISION's app notes and turn them into NVISION's "The Book" in 1990. The Book starts off with shorter versions of his first two chapters from the "Art of" book. Whereas "Art of" book delves into the engineering weeds, the NVISION book stays at the practical technician level. The book was edited by Nigel Spratling, the VP of Marketing at the time.

The book positioned them as the digital audio company. The conversion rate to sales from the book was high, many trade magazines reran the app notes. One of those books made it's way to Sony Atsugi to help them get their machine control protocol correct in their product.

The second edition of the book appeared in 1995. It was put together by Meyers, who was VP of Engineering at the time, and it was all NVISION app notes in a chapter form. It had higher production value, glossy pages, and it only had a couple chapters on video, which showed how important audio and machine control was still to the company.

The final edition of the book was published in 1999. As Dolby was now central to how many digital audio signals were transmitted Steve Lyman of Dolby contributed, Geoff Ward wrote the Machine Control Chapter, Paula Gleicher did a Fiber Distribution chapter, Rob Bowdish generated many of the diagrams, and Jill Mahanna did editing.

HD Finally Arrives

Early HD processing

Finally in 1997 NVISION began development of their first HD product, a router. At this time SMPTE was nearing the completion of its HD-SDI standard which was finalized in 1998. The standard was actually two standards. Setting the stage for the infamous 720p verses 1080i battle. Was more pictures per second, or higher resolution the answer?

Common bit rates

ESPN and Fox, two networks at the time that were concentrating on their sports programming, liked more pictures per second, as it made for much better replay presentations. ABC and Disney also went with 720p, mainly to stay in lock-step with their ESPN subsidiary. The other three alphabet broadcast networks opted for higher spatial resolution, CBS, NBC, and PBS.

This division would continue on until today. It is finally being solved by technology, which is allowing the best of each standard into a single standard (SMPTE ST2082) in 2018, also known as 1080p. 1080i 's number of lines, and 720p 's number of frames.

1080p

As we will see the HD transition started in earnest in late 2002 with ESPN's and Turner's decision to launch HD cable channels.

In 1997 Dayton allowed Meyer to spend $250,000 for HD test and development equipment. Gennum had developed a HD transceiver IC that did reliable HD re-clocking. Even with that the design of a router frame was more art than science, and internal connections for the router had to be carefully placed. Because of the high frequencies involved, the whole router cabinet was built as a RF cavity. Smaller HD routers worked better, as they had less dielectric and other losses, because they had shorter paths. At that time NVISION HD routers came in three sizes: 64 square (that is 64 inputs and 64 outputs), 128 square and 256 inputs by 128 outputs. The problem was they each had their own set of issues when it came to moving video data, with all its RF energy.

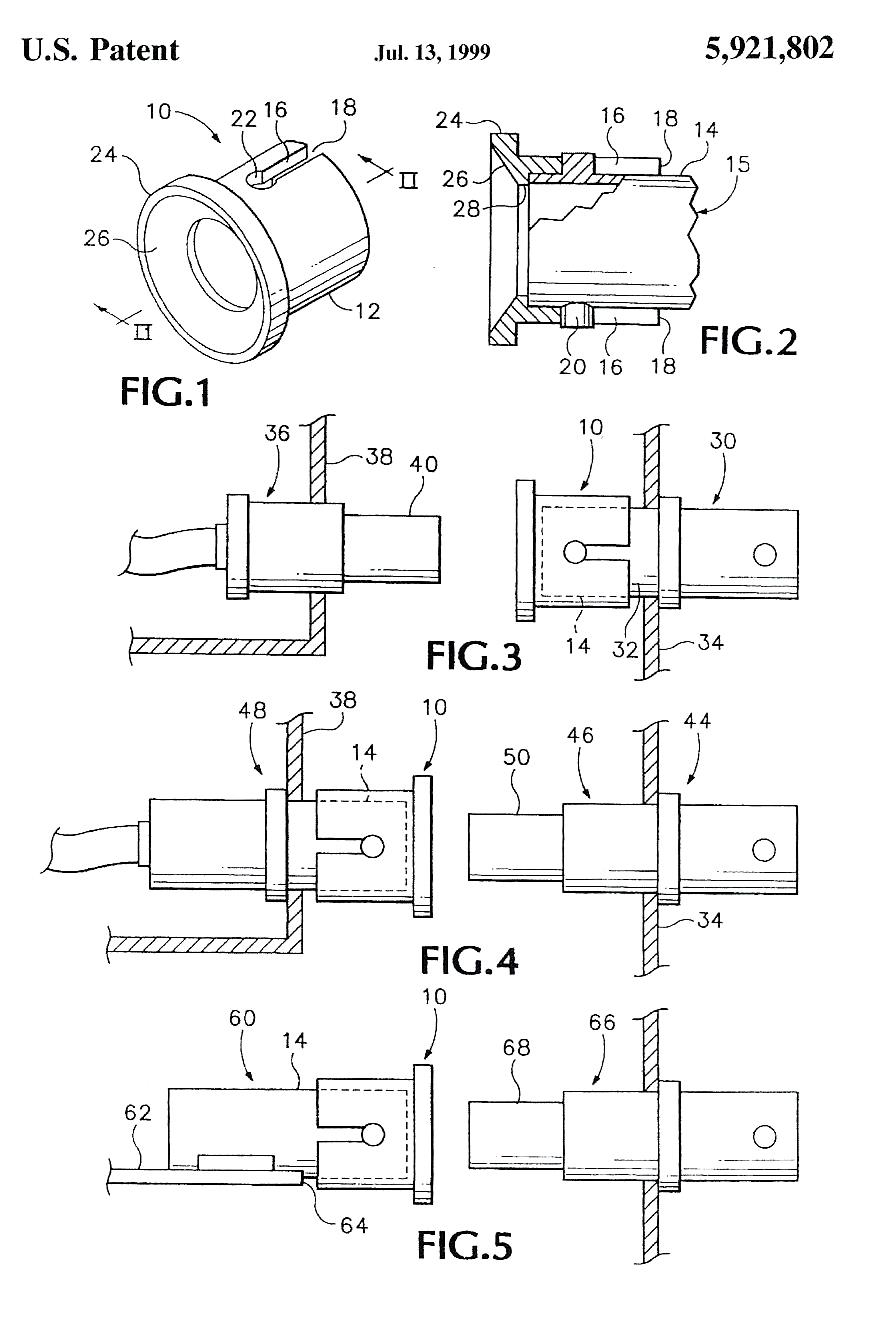

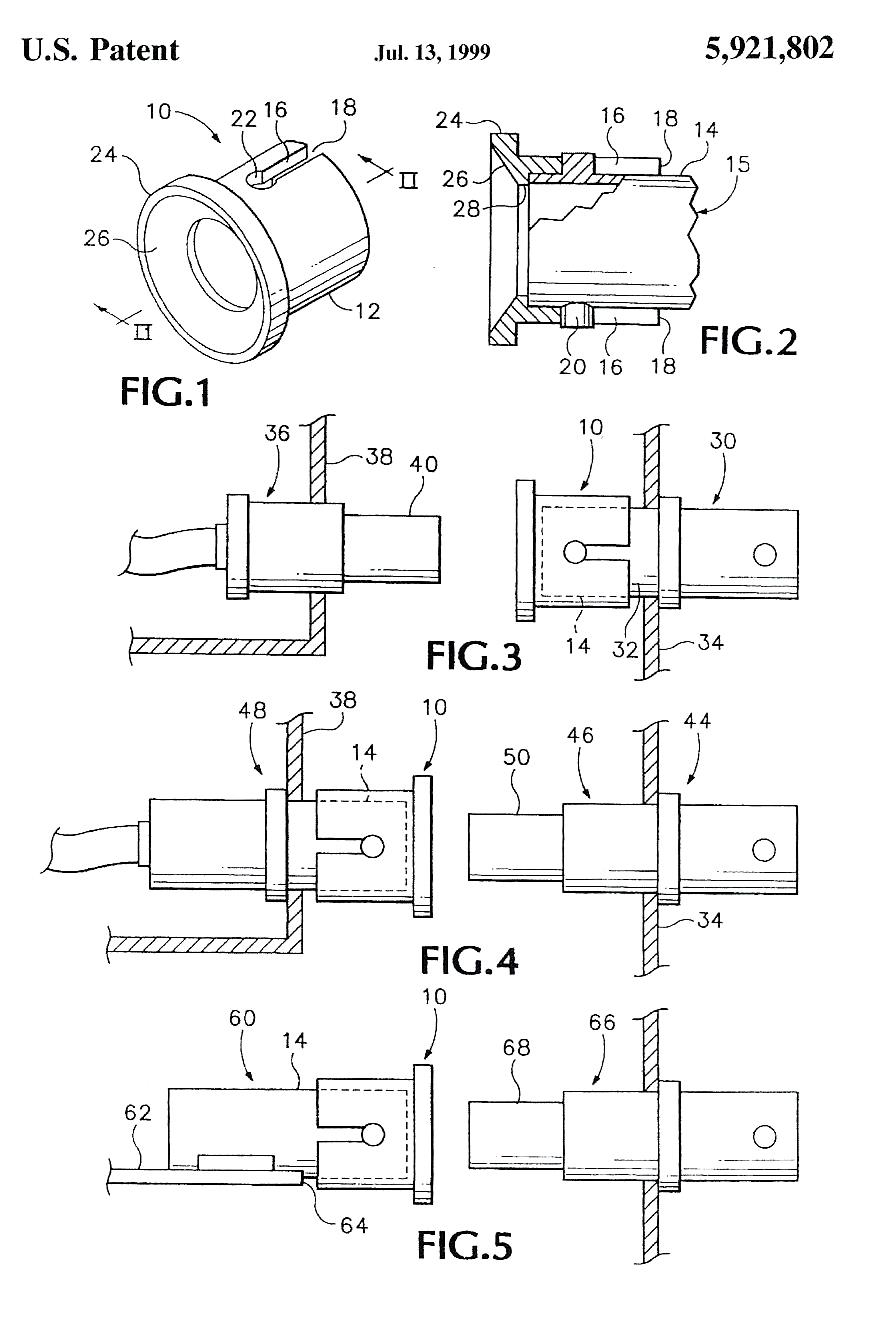

The engineering issues to produce a HD router were huge. At the time conventional wisdom, and expectations were such that there could be not active components on the backplane board, the board that all the cards plugged into. That is not that case today, but in the late 90s it was. Plus, because of the high frequencies involved, the tolerance for coax edge connectors were extremely tight, +/- 1mm! That meant that any coax connectors on the boards had to blind mate with the backplane input and output connections on the back of the router.

Bruce McChesney found an off-the-shelf connector that was flanged on one side and a normal BNC connector on the other. The flanged side would allow the board's connector to self-align into the connector when the board was plugged into the frame. NVISION design and adapter that would mount over a BNC connector that did the same thing, as sign in the patent drawings. Chuck Meyer, Dan Reis, and Scott Matheson recieved a patent for it.

The router frame itself had to be made out of aluminum as that material more closely matched the printed circuit boards thermal expansion rates. That and other processes to successfully build a reliable HD router NVISION decided to keep secret, and not patent. They felt that they were far enough a head at the time that they elected to not patent the processes used, and keep them as trade secrets.

NVISION, while not having a physical HD router in the run up to the 98 NAB, put together a notebook binder that essential showed and described how they could reliably build HD routers. The effort was enough for CBS to place an order before the convention. CBS then announced their purchace. This was done to get others on board. The intention was to keep NVISION in business.

NVISION sold its first five 6000 series HD routers in 1998. Two to CBS one to Sony for a production truck, one to ABC, and one to PBS. By the turn of the century NVISION had only sold about 50 HD routers. At the time the big dollars were going to build websites and not to HD.

Another early HD product, which was to foreshadow what was to come for the company was at the 1998 NAB , where it showed products that plugged into another company's frame, the Miranda Densitè. NVISION provided the audio multiplex cards for a fiber project that fit into Miranda's frame. There were only 10 customers. The product was used for a few special projects, plus the making of the movie 102 Dalmatians, a NBC soap opera in Los Angeles, and additional projects by Industrial Light and Magic.

Grass Valley Overtures

In 1999 NVISION got out marketed by Tim Thorsteinson and Grass Valley. Thorsteinson, as we will see was involved with the Group more than once. This was his first stint with the company. The problem he faced was that the Group still did not have any HD product to speak of. What the company had going for it was many in the industry thought HD would never be attractive enough for viewers to buy HD receivers. Also thrown into the mix was a decision that the new digital transmission system presented to broadcasters. It allowed for a full throated HD program, or multiple SD programs at the time. On top of that the broadcasters were forced to invest, on average a million and a half dollars to transition to the new digital standards by the FCC. So the dilemma was multiple SD programs verses a single HD program. The question was which would recoup the investment back faster. Many thought more was better. But as already alluded to, for broadcasters, and many other program providers, the 800 pound gorilla was and still is sports. ESPN decided the direction most would end up taking when they mandated that all their vendors providing programming, would deliver it in HD. But that was still three years in the future at that point.

Besides not having HD product that was shipping yet, the Group wasn't doing digital audio yet. They were actually using NVISION audio cards in their master control switchers, and buying NVISION digital audio routers it a customer needed a digital audio routing layer. At one point Grass Valley sent Ken James over to NVISION with a proposal. The Group offered to buy all of NVISION's production output. That is the Group would be the company's sole customer. That was rejected out of hand.

So Thorsteinson floated the idea internally at Grass Valley that the Group would buy NVISION outright. A number as high as $35 million was thrown about. Dayton and the other principles at NVISION rejected the overture, with the blessing of Meadlock. It would of been a horrible financial deal for everyone but Meadlock, as Dayton and company had only stock options in the company that had not vested yet. To end up back with the Group, they probably would of carried the options over into Tek stock, and at the time Tek's stock was headed downhill. Little did the NVISION folks know that soon those options would be in even greater danger.

So Thorsteinson did the only thing he could to slow customers migrating to vendors offering HD product, especially NVISION. He started telling customers that they did not need HD yet. Simply buy SD gear from Grass Valley and they would swap it out when the customer actually needed to go HD. At the time NVISION's HD equipment was actually the same price as Grass Valley's SD. But still many had a long ongoing relationship with the Group, and NVISION was still a bit of an unknown quantity to many. Grass Valley had blown it and this was the only recovery strategy they had. GV was working on HD (a router, switchers, and modular products) but at this time they had nothing that could ship yet.(Got a few different takes on this)

Another potential suitor also sniffed around. Someone who would soon play a role in the Group's history, Terrance Gooding. In the end Dayton concluded that he just wanted to see NVISION's books.

Dot Com Bust

Just as HD was starting to gain some measurable traction, another phenomenon made the road much slicker. It started in 1993, when Mosaic, the first of a slew of web browsers to follow, was launched. Now many more people were starting to regularly use the web. Now a new business model was born. Set up a website, grow quickly by building brand awareness, go public. Hopefully the investment from people buying the stock would allow the company to survive long enough, if its cash burn rate was low enough, until it figured out have to monetize its popularity. The vast majority of the startups flamed out before that happened. The list is long. Napster, Pets.com, Kozmo, Broadcast.com, WebVan, are a few that came with the dot com run up and then disappeared. Some biggies today survived. Amazon was started in 94, Ebay in 95, Google in 98.

The ones that did make it through that time did so by initially carving out a goal: world's largest store, meeting place, or search engine. As long as they could show progress towards those goals, the investing public and financial institutions showered them with high stock valuations, and cheap capital. Those companies took the money and invested it into business that augmented the services they had, along with companies that actually made money.

Taking Amazon as an example, in its original business, that is selling books, and doing other e-commerce, it acquired 40 companies. But it also acquired 71 companies outside its original intended business. Today a number of those acquisitions form Amazon's Cloud Computing business, its most profitable sector.

As mentioned, most did not, but investors saw the meteoric rise of stocks in the sector and wanted to cash in. At the start of this run up Fed chairman Alan Greenspan in a 1996 used the term "irrational exuberance" in a speech addressing the burgeoning Internet bubble in the stock market. What helped fuel the run up was that the top income tax rate had dropped in 1997, and interest rates were low. More people felt they had the money to invest. Investment banks, which profited significantly from initial public offerings (IPO), fueled speculation and encouraged investment in technology.

As the bubble was reaching its climax dot-com insiders cashed out $43 billion between September 1999 and July 2000, twice the rate they'd sold at during 1997 and 1998. It peaked in March 2000. During that month alone there were almost 2500 venture capital deals, involving almost $35 billion dollars.

On March 20, 2000, Barron's featured a cover article titled "Burning Up; Warning: Internet companies are running out of cash, fast," which predicted the imminent bankruptcy of many Internet companies. Just one month after peaking the Nasdaq had lost 34.2 percent of its value. From 1995 to 2000 the Nasdaq rose over 500%, and by October 2002 had plunged 74% from its peak, giving up almost all of its gains. It was later estimated that between 2001 and early 2004, Silicon Valley alone lost 200,000 jobs. In the space of a decade, a group of people had gone from being young upstarts who "got it," to masters of the universe who were transforming the world, to completely redundant. Many have made the case that the dot-com era was doomed to failure simply because there were too many companies chasing what at the time were too few users.

There was an upside: All of the money that was poured into the tech companies during this time created an infrastructure and economic foundation that would allow the Internet to mature.

But that came at a cost. There was also a bubble in the telecoms industry that was called "the biggest and fastest rise and fall in business history" by The Economist. An example was Qwest. What became Qwest was founded in 1988 by Philip Anschutz, who owned the Southern Pacific Railroad at the time. He established a subsidiary called Southern Pacific Telecommunications Company and it perfected a way to lay fiber along railroad rights-of-way at the rate of eight miles per day. An unheard rate. It used a $1 million, 76-ton rail-mounted plow that laid the pipe next to the rail line at a depth of four to five feet. Qwest proceeded to create SONET OC-48 (2.5 Gbit/s) fiber rings around the country, all interconnected at numerous switching points along the ring. The first was close to Grass Valley, between Sacramento and Los Angeles.

An interesting anomaly has come back to bite companies like Qwest, and AT&T. In some situations and locales the courts have ruled that the railroads generally do not own the land, they only have the right to operate trains on that land, not to lease the land for other uses. This has resulted in some large sums of money changing hands.

To fund the laying of two 78 strand fiber bundles per ring, Southern Pacific Telecommunications Company sold fiber strands in each bundle. The fiber network was 18,500 miles long. In 1995 the SP subsidiary was spun off and assumed the name of Qwest. It went public later that year. In 2000 it bought spun off baby bell U.S. West and re-branded it Qwest also. Qwest, like a number of other telcos thought the dot-com boom would continue and that all the fiber capacity would soon be in demand. It never happened and the vast majority of Qwest's fiber strands are still not in use. The capacity was so great that the company ran an television ad in 1999 where a guy shows up at a seedy motel and inquires if the rooms have entertainment. The clerk replies "any movie ever made, any language, anytime." While true the qualifications were standard definition, and that the anytime meant that any desired movie would start every minute, not necessarily anytime.

The telecoms bubble and crash cost investors almost a trillion dollars. Another effect of a result of the greed and excessive optimism, especially about the growth of data traffic fueled by the rise of the Internet. This would come to affect NVISION into the new century.

But there was a downturn in the television industry as the dot-com run up was occurring. As we have mentioned already, over the air digital TV was lighting up at this time. A good part of the broadcasters budget was going to buy new transmitters, antennas, and towers. That was sucking up a major chunk of the broadcasters technical budget during that time.

But the other big obstacle that faced companies like NVISION was the web. Everyone, including broadcasters, from large ones to the few remaining "mom & pop" broadcasters, now had to have a website. Broadcast equipment vendors at the end of the century had customers saying they did not have money for new equipment outside of what was required to put their digital transmitter on the air, and at the same time to pay for website development. Between the two the outlay could be anywhere from a $250K to north of two million.

While they were transmitting digital television, and were in the digital realm of the internet, nothing else had to be digital. Most broadcasters at the time simply kept their analog infrastructure and only converted it to digital where and when necessary. No new routers, switchers, or other infrastructure required. Another impediment was that for a while many thought that advertisers would move to websites and off TV, as the classifieds had moved from newspapers to Craigslist.

After venture capital was no longer readily available, the operational mentality of executives and investors completely changed. Supporting industries, such as advertising and shipping, scaled back their operations as demand for services fell.

There was one other initiative that was funneling money away from traditional equipment sales, and it was a cross between the Internet explosion and the increased connectivity from the telecoms. It came to be called "centralcasting." The concept was to centralize operations of stations in multiple markets in a central location. Many architectures or topologies were tried. These operations included centralizing master control, and traffic.

Traffic is the process of compiling all the commercials the station has sold, the programming it will be aired in, and generating a log, today it would be called a playlist, to orchestrate what was aired and when. Early on the log was used to select which video tapes or reals of film to load up, when to start playback of those, and then manually switch them to air. By the dot-com bust that log, still called a log at that point, was fed into an automation system, computers with various software which started tape, not so much film at that time, and it controlled the switching of sources to air. Today it's a playlist that controls a video server that contains everything except what is done live, almost exclusively news in most local stations, or progams from the network.

Television traffic systems were literally an outgrowth of American Airlines original Sabre reservation system. Sabre's goal was to fill every possible seat for the highest price possible before the plane left the gate. The same principle was applied to television traffic. That is, sell every commercial spot, for the highest possible price before the time slot came and went. Thus if you want to buy time on a local station at a precise time, say the opening segment of the local airing of Jeopardy, you will pay handsomely for it. So most who buy time on a station buy into a rotation. This means your spots will air at various times, some during prime time, and many in not so prime time, but you are guaranteed a certain amount of airings in the better time slots. The traffic system is literally juggling where various spots are airing right up to the time the log, or playlist is generated. Back during this time it was once a day and fed into the automation system. Today it can update the automation system throughout the day.

The increased Internet, or cloud bandwidth had station groups, that is companies that owned multiple stations, looking at centralizing master control and traffic functions, and stream out the various program streams to the various stations. Other station groups tried simple remote control strategies. An early example were the stations owned by the New York Times. They literally used PCAnywhere to control automation from a central site with rudimentary monitoring of each station.

Other stations, notably stations owned by Sinclair, went further than just master control and traffic. Often the positions eliminated from those two areas are often some of the lowest paid employees. So Sinclair tried to centralize news. Stories would be captured locally, but then uploaded to a central production site. From there each local stations newscast would be put together and streamed back either live, or even recorded ahead of time based on the various time zones the stations were in and how many newscasts the central facility could do at once.

This saved chiefly on talent, as now each station didn't need a meteorologist as an example, a couple for multiple markets would do. This concept was much like voice tracking in radio, where a single DJ would record all the interstitial content, song intros, and other banter, ahead of time, for multiple stations. It's how Topeka could have a commanding Los Angeles 60s sounding DJ. These centralized talent and production crew experiments eventually mostly fell by the wayside.

In addition, video server and automation technology got to price points where it was cheap enough to leave the local content on local video servers. But traffic systems have pretty much stayed central.

One final impediment was what came to be known as the Y2K problem. An article in 1993, interestingly near the start of the dot-com run up, by Peter de Jager was called "The information-age equivalent of the midnight ride of Paul Revere" by The New York Times. The problem many feared had to do with the cost of computer memory at the time, and as such to save memory space, often software, both the OS and applications, often truncated the date, eliminating the century part of the year, that is 1989, was stored as 89.

A couple problems cropped up even before the year 2000 arrived. Applications that had to deal with years 2000 and on started displaying problems. Some programs that managed credit cards with expiration dates past 1999 had problems. Most applications that had Y2K issues were fixed with software patches, as problems would only be encountered if dates were used in calculations.

Microsoft right before the 2000 New Year claimed the problem was over hyped. But like most industries broadcasters were concerned and that preoccupied some of their time, and capital. When the time arrived, only minor problems cropped up. Japan seemed to have more than their share of them. A few websites written in Java, reported the first day of the new century as 1 Jan 19100.

Besides the Y2K countdown NVISION, and the Group itself were in countdowns of their own.

All of this added up to a dearth of sales towards the tail end of the 90s. While NVISION was holding its own up until the the last couple years of the century, and was actually growing in the mid-90s, all that had stopped, and NVISION was again burning through cash. Meadlock was now open to selling the company.

Sale to ADC

Right at the end of 1999, December 31st to be exact NVISION was sold to ADC for $19.7 million. The timing was for tax purposes. ADC had gone on a $373.1 million buying spree in 1999, acquiring 10 companies, NVISION included. ADC was chiefly known for patch panels and connectors focused on telecommunications. It had gotten into fiber in the 80s concentrating on video transmission.

In the 20 years leading up to the NVISION sale ADC had bought dozens of companies. It was trying to become a total provider of video services for the telecom industry. A lot of the funding was because of the explosive growth in DSL, and other high speed Internet connectivity to the home. That required a lot of equipment that ADC sold. But right before NVISION was bought that business was drying up due to the dot Com bust.

But even though ADC's sales kept growing, its stock price took a sudden plunge in early 1998. The company reported a net loss of $13.2 million for the first quarter. The drop was attributed to a faltering performance in the company's broadband connectivity group. Although throughout the rest of that year the company continued to grow, and sales of $1.5 billion was achieved for the year. But early signs of fiber infrastructure over abundance was starting to show. The same exuberance that was overtaking television equipment vendors, started doing the same in ADC's industry.

ABC at the time was in the process of accepting delivery of a NVISION router for KABC. ABC did not like ADC. NVISION did manage to sweet talk ABC into taking it.

Meadlock walked away with 12 million in cash. The others no longer had founder positions, just stock options from ADC. When the ADC stock augured into the ground soon after the sale Dayton saw $4 million in stock go down to $100,000 in about four weeks.

Jay Kuca went to work for NVISION right after the ADC purchase, having given up on the Group. He almost immediately saw the mis-direction that ADC was inflicting. It bought the company because, as we will see on a larger scale later, because they were in an adjacent market to ADC's, but that did not mean they knew how that market worked.

From the start ADC did not know what to do with NVISION. They shut down NVISION's marketing and sales force and insisted on their own sales force sell into a market they knew nothing about. Bill Amos retired. Much like the experience GVG had with Tektronix earlier. While television and telecom are both high tech, so is space flight, and the ADC sales force would not have fared well in that realm either. The company was in such a state of disarray with trying to integrate all the recent acquisitions that they built a 790,000 square-foot building in Minneapolis they never used.

As we will see later they had bought another local endeavor they did not know what to do with either. While the strategic plan might have been to offer end to end solutions bridging the telecom, television, and broadcasting realms, no one on the ground had any grasp of how to do that.

Soon the NVISION folks came to realize their existence was in trouble.

Within a year talks with what who would eventually be not only NVISION's overlords, but the Groups also, started. Miranda Technologies was another vendor of video infrastructure products for the broadcast, audiovisual, video-conference, and video transport markets. The company was headquartered in Montreal. ADC approached Miranda about buying the company.

For about a year Miranda tried to buy NV from ADC. For NAB 2002 NVISION was actually a part of the Miranda Booth. Eventually ADC figured out that Miranda didn't have any money at the time and was just trying to get the company on the cheap. Unbelievably, ADC, not knowing what else to do with NVISION, just decided to shut it down. At the time NVISION had over 40 technology patents, and now it was facing extinction.

We will pick up the story again in chapter 15.

Completing the Digital Food Chain

The table stakes for television broadcasters have always been complying with the rules and regulations laid down by the FCC. Technology early on was such that broadcasters had to strictly transmit signals that the FCC deemed legal. Some of the restrictions were so that the television receivers, which were much less sophisticated than they are today, could recover those signals. Since broadcasters were provided a public monopoly, it was deemed that they would be highly regulated.

It was always a given that most broadcasters would never willingly move to new technology unless forced to. Those forces could come from other broadcasters. But usually those forces were forced upon them from outside the broadcast community. Back when there was a dominant player in the television industry, RCA could force it's broadcasting arm, NBC, to produce shows in color using RCA supplied gear to promote the sales of color television receivers. In the realm of HDTV, we recently saw how Sony started the push to HD. Like RCA could, 60 years ago, in the 80s Sony had enough of a vertical infrastructure, both a television receiver business, and a broadcast equipment business, to plant the seeds for a grass roots demand for better television resolution.

The late Julius Barnathan, when he was Vice President of Operations & Engineering at ABC claimed that Japan bought forth HDTV because the NTSC TV receiver industry was saturated. They wanted a new market.

The HD purist initially claimed that HDTV should have 30 MHz of bandwidth. Sony soon came to realize that if they were going to make a business out of HD they were going to have to find another way. In addition they realized that while analog could provide an avenue to wet the public's appetite, only digital would make the new format viable. Besides Sony, both Panasonic, and Philips had broadcast and consumer television gear for sale. But none had the broadcast distribution channel, namely a television network to promote DTV. But Sony had acquired Sony Pictures (formally Columbia Pictures) in the early 90s, and so it was a content producer with no distribution channel like Disney or Fox. Conversely, Disney nor Fox had broadcast or consumer manufacturing operations. So no entity had the leverage over the entire food chain to promote DTV.

Broadcasters themselves had no interest in that new formats had never increased their revenue, at least not initially. Color had not done it, and early standard definition digital wasn't either. Broadcasters would have to re-tool their entire facility for a new digital format. Many facilities in the 90s were starting to go "digital," not islands but complete end to end. But these were standard definition digital systems. While they improved slightly the picture quality, they were not HD. Digital video by itself brought improvements in reliability, flexibility, and was easier to to implement piecemeal if need be. Plus digital video gear had no impactful price difference. From the technical side, digital video was simpler to understand and cope with than analog video.

Not the same with digital audio as we recently pointed out. Everything about it was more complicated and expensive. Early on in the digital television evolution, often the video plant would be digital, but the audio side stayed mostly analog. It wasn't until four and six channel sound became popular that digital audio could begin to pull it's weight. Multiple channels of audio could be embedded into the video bitstream. That meant for much of the audio food chain, you did not need six sets of audio wiring for six-channel audio. This also helped ensure that the video and audio stayed in sync, minimizing lip-sync issues.

So while on the content creation end the digital revolution was now under full swing, the main bottleneck remained getting an HD signal to the home. Either via over the air transmission, or through a cable system. Cables systems, and viewers, at this stage were into more channels and not ones with better pictures. Bandwidth is a precious resource, and if a cable systems was willing to invest in systems that had wider bandwidth, they didn't want to fill that spectrum up with "fatter" HD analog signals.

Analog approaches proposed for HD

A number of broadcasters and companies proposed systems, but at the time there was much more synergy between Japanese broadcasters and vendors, namely Sony and Panasonic. The United States electronics industry, which were very sensitive at the time that "Japan, Inc." was going to dominate another technology sector decided they better do something themselves.

ACATS

In 1980 the Society of Motion Picture and Television Engineers (SMPTE) started taking an interest in HD. Birney Dayton was one the technical chairs. He co-chaired the working group on HD electronic products from 1980 to 1984 which met in Hollywood. He was the technical chair while Dick Stump from Universal Pictures was the administrative chair. Their result was the SMPTE 240 analog HD standard.

By the mid-80s the FCC decided they needed to get involved, so they formed the

Advisory Committee on Advanced Television Service, or ACATS in 1987 to recommend an Advanced TV standard for the U.S.

In 1987 Dayton was tapped to be the chair of ACATS Working Party One (WP1) analysis group. Their job was to filter the 23 HD proponents that were out there at the time, including the ones mentioned above. Larry Thorpe, originally with RCA, now with Sony, was running the economics analysis of this group. Mark Richards of PBS was running the test group. Dayton ended up in a group that was trying to shoot down COFDM. We will look at the COFDM/8-VSB arguments in a bit.

Dayton represented GVG. Although the company was doing nothing at the time towards HD, as we have seen, he thinks that probably the company wanted to create the appearance that the company was doing something. He was running Grass Valley's WaveLink group at the time (more of a telecom product than television product) and his nomination to run WP1 came from Irwin Dorus (Executive VP of Bell Communications Research), so Birney's ATSC role came from the telecom side, not from the broadcast side and likely another reason why GVG's management did not get in the way.

By 1991, ACATS had reduced the number of proposals down to six, which included four all-digital HDTV specifications. ACATS worked closely with the ATSC (Advanced TV Systems Committee), a private organization that was originally founded in 1982. ATSC developed and documented the "Advanced TV" or ATV specifications and were also responsible for including SD formats in the standard for compatibility with computers.

In 1992 Congress voted on and the FCC enacted rules that each existing broadcast station would be paired with a second 6 MHz channel during a transition period, one to continue analog transmission, and a second for digital. By 1993, the digital system proponents (AT&T, Philips, General Instrument, Thomson, MIT, and Sarnoff Research (what was left of RCA)) banded together as the "Grand Alliance" to create a single (ATV) standard.

By this time ACATS had decided that no analog systems would be considered any longer. This was twofold, one technical the other political. Politically, with analog, the Japanese were way ahead of the U.S. The second, technically it was believed by many that the only way to make the adopted new standard flexible and robust was with a digital approach. The committee encouraged a merger of best elements of the remaining systems under consideration.

In 1995 the ATSC approved the ACATS ATV Standard, and a year later the FCC did the same.

It should be mentioned that a few broadcasters became proactive early on and collectively setup facilities that acted as "model stations" to test the various technologies. One was actually called the Model Station, and it was set up in the basement of WRC, an NBC owned station in Washington, D.C. This was the site of the earliest color videotape recording still in existence. Introduced by RCA President Robert W. Sarnoff, it is a recording of the dedication of WRC-TV's Washington studios on May 22, 1958. President Dwight D. Eisenhower spoke at the event, it was also the first time a U.S. president had been videotaped in color.

Two other distinct test facilities existed. The Advanced Television Test Center from 1988 to 1996, and the Advanced Television Technology Center from 1996 to 2003. Both facilities were located in Alexandria, Va., in the same building that housed PBS's headquarters. These projects tested the various proposed systems. These were also sponsored by NAB, ABC, CBS, PBS, the Association of Maximum Service Telecasters, and the Association of Independent Television Stations.

VSB verses COFDM

There were two methods proposed for modulating digital media, and other data onto an RF carrier. The first scheme is known as COFDM (Coded Orthogonal Frequency Division Multiplexing). This is a form of Spread Spectrum transmission.

COFDM

The other contender, 8 bit Vestigial Sideband Modulation, or 8VSB, and it was only possible because of the processing power that became available in the 90s.

8-VSB

The argument between the two approaches hinged on each having what has been called slim advantages. COFDM is said to have a "urban advantage" as it does better with multi-path, that is signals that are bouncing around urban centers. 8VSB is said to have a "fringe advantage." 8VSB signal transmits more average signal strength and thus coverage out in the hinterlands which would be better for viewers a ways out. Studies indicated that the number of viewers impacted by one method, was almost equal to the number of viewers impacted by the other method!

Today the technology has improved so much that regular QAM, the technique used by most modems, is better at throughput today than 8VSB. Smaller semiconductors in use now have less noise. This means denser modulation constellations like 64QAM, and even 256QAM are often better options now. Also, the telecoms like QAM because as it has been how they tend move signals.

During the ATSC discussions Dell Parks, of Sinclair, and others wanted COFDM. Birney Dayton wanted 8VSB. Later when Dayton was at NVISION, he said they never sold anything to Sinclair as an independent company. Most likely because Birney opposed Parks on ATSC. An interesting note is that a new version of ATSC is being finalized and Sinclair, which still was pushing for COFDM in the new system, appears to have won this round.

The other early difference on opinions about SD or HD was ATSC's advantage. In 1997 the ATSC standard settled on MPEG-2 for video compression. Both modulation schemes allowed about 20MBps data rates. With the compression technology of the time, that meant there was enough bit rate to handle a single HD program, or 4 to 6 multiple SD programs depending on the bit rate allotted to the various programs. While Congress pushed for HD, initially over 60% of people thought the key selling point of DTV was more free channels. The rest were divided between HD and the idea of DTV's ability to provide Internet content.

Most viewers claim they did not care about online, supplemental information for entertainment programs. Most people who surf the web viewed it then, as today, as a distinctly different activity than viewing television. You usually sit upright, when browsing the web. It is usually an activity done alone. These are attributes most people don't subscribe to while watching television.

Broadcasters were forced to do DTV. To many this meant only a DTV transmitter initially. That made television transmitter companies happy. That left broadcast equipment vendors like Sony, Phillips, Tektronix, not so much. While the average broadcaster was not against DTV, they just did not want to get critically injured by it. Many were hoping for DTV's demise. Cable companies, along with the PC industry were in that camp.

Cable would win if DTV failed, as they were trying to implement some sort of advanced television themselves. The PC industry derived no benefit from DTV, as they were in the early stages of trying to usurp broadcasting.

Going HD

HD eventually opened a lot of new territory. One of the biggest was the replacement of film in the film industry. As late as 2012, seven of the nine Best Picture nominees were shot on Kodak film. However, the move away from film had forced the company to abandon its sponsorship of 3300-seat Kodak Theater that year. Kodak can no longer afford the marketing boost that the Oscars gave it. Digital editing and the fact that almost all commercial screens are using digital projectors have decimated the company's film printing business. At its height, film processing was a 12-billion feet-per-year business, and now it's under a billion. It used to take about 1 million feet to shoot a feature film and 100 million feet to print enough for distribution. Today that business is close to nil.

While HD video today has eliminated film for the most part, movie producers still are going after the total film look. For a couple decades as cinematography moved to video equipment, the television and cinema folks had very different methods and expectations for common types of equipment, especially cameras. Film had a subjective quality different from traditionally recorded video.

Things that make video look like film are the dark areas of a scene. The blacks are much more suppressed in video than in film. Pushing camera gammas (camera transfer function) up to the 60 to 70% range helps. Professional television cameras for the past 30 years have circuitry that enhances the edges of objects in the scene. This makes the picture look crisper. This circuitry is called enhancement or detail. Minimizing camera detail levels by setting detail threshold at 30 to 40 percent of peak luminance will help achieve the "film look." This means that areas of low light don't have much enhancement while highlight areas do. Today's cameras can have varying frame rates. Some shoot at the 24 frame film rate. The gain of a camera can be increased to give a film emulsion "noise" look. The BBC reduces chroma levels in the camera to get closer to film color saturation levels. Film also has much less depth of field than video does. Lower lighting levels will create this in video. Kodak at one time claimed HDTV wouldn't equal 35mm film quality until CCDs had around 2 million pixels. Today the highest resolution imagers are over 40 million pixels, and they are even in cameras with a 35mm optical format.

Early HD equipment cost 10 times what today's do. Some early producers of HD programming found that they could not compete with upstarts using drastically cheaper, lighter, and less power hungry gear. CCD imagers got smaller. Almost to a point where physics got in the way. Smaller CCDs do not allow the same quality of lens for the smaller imager, thus some claim newer HD cameras don't have the resolution that older ones had. This is generally not because of the cameras themselves, but that smaller imagers called for inferior lens.

DTV Matures

Technology used for DTV created a decoupling of production, transmission, and display formats. The industry has now been through a number of evolutionary steps as analog video faded into the past. Each new milestone brought the vendors a temporary bump in sales for these trials, followed by a lag.

Digital over the air started in 1998, and after about 6 years, full scale facilities were designed and deployed. The transmission and distribution went completely digital along with more and more of the core facility. After another 10 years, the worldwide penetration of HD video was nearing 100% of the available market. While there is some migration up the ladder to 1080p and 4K, some say the industry is in a format stall. Companies like Grass Valley and others in the industry, and the area, found a way to ride out the lag. It helped to watch carefully what the early adopters did, and then get ready for the next evolutionary wave. Some of the propulsion came from the end of the last centuries government regulatory policy. It was not based on free market forces, or a strategy to harness them.

Technology applied to the new media formats have provided an opportunity to enter new markets. But conversely it works both ways, as others whose core competencies were related, but separate, are now finding that they can complete in markets once dominated by the traditional television folks.

One governmental action that made this possible was the FCC Telecommunications Act of 1996. While aiding DTV and then HDTV, it made and gave businesses access to increased bandwidth. This lead to devices like the iPhone, and others by supercharging cellular, WiFi and data services so in demand today. It also changed the distribution paths for DTV. Now the viewer, maybe now more adroitly called the user, does not need an antenna, or a cable or satellite provider, not even a physical Internet connection if they so desire. More and more it's not real time video delivery, but asynchronous digital streaming delivery.

Too late too to the Game

Playing Catch up

Let' look back at what the Group was doing while NVISION was finding it's legs, and during the tumultuous run up to the end of the century.

GV was in dire straits in 1991 through 1993, at that time GV shipped a bunch of 1.0's products. While digital, SD only, was now part of the Groups offerings, HD was really not even on the drawing boards yet. The group was now mainly reacting to outside events and not pioneering on any fronts. Tek was toying with a early video server. When it came to digital technology Tek was definitely ahead of the Group in its implementation. The Group$apos;s sales dropped $17 million in 93 from 92 levels. While it rebounded in 93 it dropped over $10 million again in 93.

The 3000 had been launched in 91, followed the next year by the 4000. It played catch up with digital switchers in 93 and 94 by launching another three digital switchers. Again all SD only.

Tektronix Profile Server

Tektronix Profile Server

Tek became serious about its own server with the introduction of the Media Pool by Philips in 1994. Video servers were only practical because of digital technology. In 1995 Tek shipped its first server, the Profile PDR-100 to NBC. Sony was marketing their own line of digital video production switchers. Also in 1994 DirecTV signed on. It was definitely becoming a digital world.

The Tek Video Division designed and introduced the Profile server, but turned it over to the Group in 94 when it combined the two into the Video Network Division.

Profile LVS Event Management

System Controller

One bright spot was using the Profile as a editor, and replay device, which NBC helped poineer in 96. Profiles ran on Microsoft's NT OS.

Finally in 96 the Group released its first digital router, an SD version of the 7000. That year also marked a major advancement in bringing digital to the home, the DVD was introduced.

Spinning apart

Towards the end of 1997 it was becoming apparent that the Group was not carrying their weight financially.That year the division lost $17 million which reduced Tek's earnings by 35 cents per share. On the year, Tek made $3.48 per share, but it would have been closer to $4 if it was not for the Group. The only good news was that the division lost $27 million in fiscal 1996 on sales of almost $400 million, so 97 appeared to be a ray of hope. But that did not last long, as the division lost a record amount in 98 and 99.

Tek's Video and Networking Division, essentially Grass Valley's income, had been a drag on per-share earnings. 1995 was the Groups best year at contributing to Tek's bottom line. It was 23.1% of total revenue that year. Over the next two years that percentage fell back down to just under 16%. While the whole Video Network Division was racking up record amounts of revenue, almost $450 million in 97, the Grass Valley lack of contribution was hidden by the fact that the Group's revenues were combined with the Profile server revenues starting in 1995, and no longer broken out separately. In 95 Grass Valley contributed a little more than half of the VND total revenues. By the late nineties the server business was the bulk of the revenue. In 1997 VND reached its peak at almost $450 million in revenue. The next year though the floor dropped out from under VND's when it dropped just over $50 million. But that was greatly surpassed the year after that when $100 million in revenues from the previous year dissappeared.

At the time Tek and analysts said the division needed to improve routine business operations, emphasize product marketing, increase the flow of new products and respond more quickly to technological change, particularly in the video and television industry, before the division could return to profitability.

In September of 98 Jerry Meyer, Tek's then chief executive and chairman, announced plans to streamline the division's product offerings and reduce its cost structure. That meant layoffs. Which were becoming a tradition towards the end of each fiscal year. He eliminated around 250 positions, or about 16 percent of the division's 1500 strong work force. 30 or 40 were left go in Portland, and about 200 down in Grass Valley. This was indicative of the problems in the Grass Valley video division, verses the relative success of the server group up in Portland. This was billed as an effort to quickly make the division profitable again. The moves resulted in a one time restructuring charge of $55 million.

While the Group still had a strong brand name, its video sales had greatly slumped. Tek finally addressed excess inventory issues, and pruned obsolete product offerings. Grass Valley trimmed its product roster from 1,700 offerings to around 500. Timothy Thorsteinson was brought in August of that year to replace Lucie Fjeldstad as president of the division in late-August. We will look at that saga in the next chapter.

Besides being slow to digital video, the other thing that was happening was the start of high-end systems being replaced by personal computer-based systems, and Tek was not able to compete in that trend. In an effort to combat this the Group brought Newstar, a company that supplied editing, and asset management systems for television newsrooms. 98 was monumental for the group. Besides all the bad news, the good news was that they announced HD switching, routing, and modular products. But they were not being shipped yet, and this is when Thorsteinson started his "buy our SD product and we will replace it in the future with HD at no charge" campaign against NVISION as we discussed earlier. This was a valiant effort to keep cash flow up in the present, at the expense of future income. But without product that many were starting to consider, namely HD, it was all they had.

In a management meeting in early 99 the following conclusions had been reached regarding Grass Valley:

- Hadn't met revenue/profit plan

- Poor forecasting performance

- Deteriorating customer quality

- Non-competitive lead times

- Long development cycle-times (missed serveral market windows)

- Poor delivery performance

- Slipped engineering schedules

- Excessive rework

- Outflow of key talent

- Lack of experienced management

- Excessive inventory

The bottom line at the meeting was: "Lack of accountability leading to....loss of confidence

GVG is a deteriorating asset"

In June of 1999 Tektronix decided it didn't have the resources, nor the patience to fix the above list. Plus on a larger level the company finally decided to do what Soros and his group had been pushing for: to break up the company. So to pull the plug and announced plans to exit the video business. In addition it decided to form two separate, publicly traded companies. One company was comprised of its measurement business, while the other was comprised of its color printing division.

Aug 10, 1999, Tektronix announced it would sell its video content production business, including the Profile servers, to the Grass Valley Group Inc., a California-based investment group, led by Terence Gooding. Tektronix kept a 10% equity stake in the new venture. The Group continued to be based in Nevada City, but would also inherit an engineering design center in Beaverton, Ore. For a long time Tek had dropped the Group from the Grass Valley name, it became Grass Valley Group again at that time.

The new company had 700 employees worldwide, and annual sales north of $200 million. At that time 80% of TV signals worldwide passed through GVG products. Gooding served as chairman and CEO of Grass Valley Group. Tim Thorsteinson, who was Tektronix&s video and networking division president, joined the new company as its president.

![]()

![]()

![]()

![]()